#forecast 013 : The $1T resistance

Dear subscribers,

Welcome to The Bitcoin Forecast #013.

In my last letter, I outlined BTC had outstripped fundamentals but despite this I expected price to consolidate for a week before breaking out. Since then BTC moved sideways bullish for 6 days before breaking out rallying to $58k before a violent pullback as margin traders in heavy long positions were liquidated.In

summary

In actuality, not much has happened from an on-chain lens. The violent price action originated solely from derivative exchanges as traders entered extreme levels of long positions driving market capitalisation above $1T and then sold off in a cascade of liquidations.

Top level summary for 26th February 2021 (current price $49.6k):

> 1. BTC experienced a speculative bump in the road as price rallied and then detoxed from an all-time-high as margin traders bought BTC on speculative news, then dumped their positions, most likely due to a scare over a

phantom $1.5b seller.

> 2. Retail investors are entering in very large numbers while institutional capital continues to flow into the network unabated. Long term investors bought the dip as price dropped.

> 3. Microstrategy and Square announced they added $1b and $170m of BTC respectively to their corporate treasuries by the time price had ended its correction.

>4. Short term: Sideways to bullish consolidation is expected for 1-2 weeks before a further bullish breakout with $63k and $74k as next targets. Price is still quite warm so a bearish path is possible though unlikely.

Should price breakdown below $47k which is a strong support zone, $40k presents a no-brainer buy zone.

>5. Long term: Unchanged from my last letter, we are in the middle of the main bull phase with a $200k-$300k price target.

All the best, till next time.

-Willy Woo

Analysis Breakdown

Bitcoin broke past another all-time-high on 8 Feb with the news that Tesla had purchased $1.5b of BTC. This breakout was caused by margin traders buying on this news. We can see this from the rise of funding rates they needed to pay to hold their long positions.

Glassnode:

live chart (Advanced account requited)

Here’s another view of it below, showing a sudden jump in price above the fundamentals supported by long term investors.

At $58k, BTC was trading high above fundamentals with plenty of room for a pullback. In a rather sudden sell-off, margin traders sold down their positions, which eventuated in a classic long squeeze; a house of cards as long positions exit on top of each other, selling down the price, which triggers others to sell below it. A total of $2.5b of long positions were liquidated in a 48hr period.

The sell-off coincided with a spike of BTC flowing into exchanges, I suspect this is the likely culprit, “red alert” warnings were forwarded between traders. Pictured below is the spike showing $1.5b of BTC flowing into exchanges to be sold.

This was a DATA ERROR. I spoke to Glassnode’s CTO during the cascade of liquidations and can confirm this was a wallet labelling error from an upstream data provider. (What we were actually seeing was an internal movement of coins inside Gemini exchange.)

During this time, investment flows continued into Bitcoin’s network unabated with no shake-out of new investors. We can see this in the chart below where SOPR climbed against the sell off.

This is VERY unusual occurrence. SOPR can only climb against a price decline when recent buyers hold their coins, and new buyers are stepping in to buy the steady stream of coins being offered by sellers who bought a while ago carrying greater profit.

In summary, new investors bought the dip while traders buying on leverage were liquidated.

Capital flows into Bitcoin remain unabated

IWhile short term traders have been liquidated driving price downwards, capital flows from US institutions continue to pour in. Tracking the USDC flows into exchanges is one way to get a sense of this.

Glassnode:

live chart (Advanced Plan required)

During this dip coins moved to investors with strong hands (see the increase in RED in the chart below over the last 3 days). These are participants with a history of accumulating coins without selling.

Glassnode:

live chart (Professional Plan required)

Bitcoin is presently “not too hot, not too cold”

Here’s a look at the “organic” price supported by long term investors. The price floor model is currently at $39k on a daily close.

The Floor Price is derived from capital inflows into the network, while NVT Price tracks on-chain volume moving between investors.

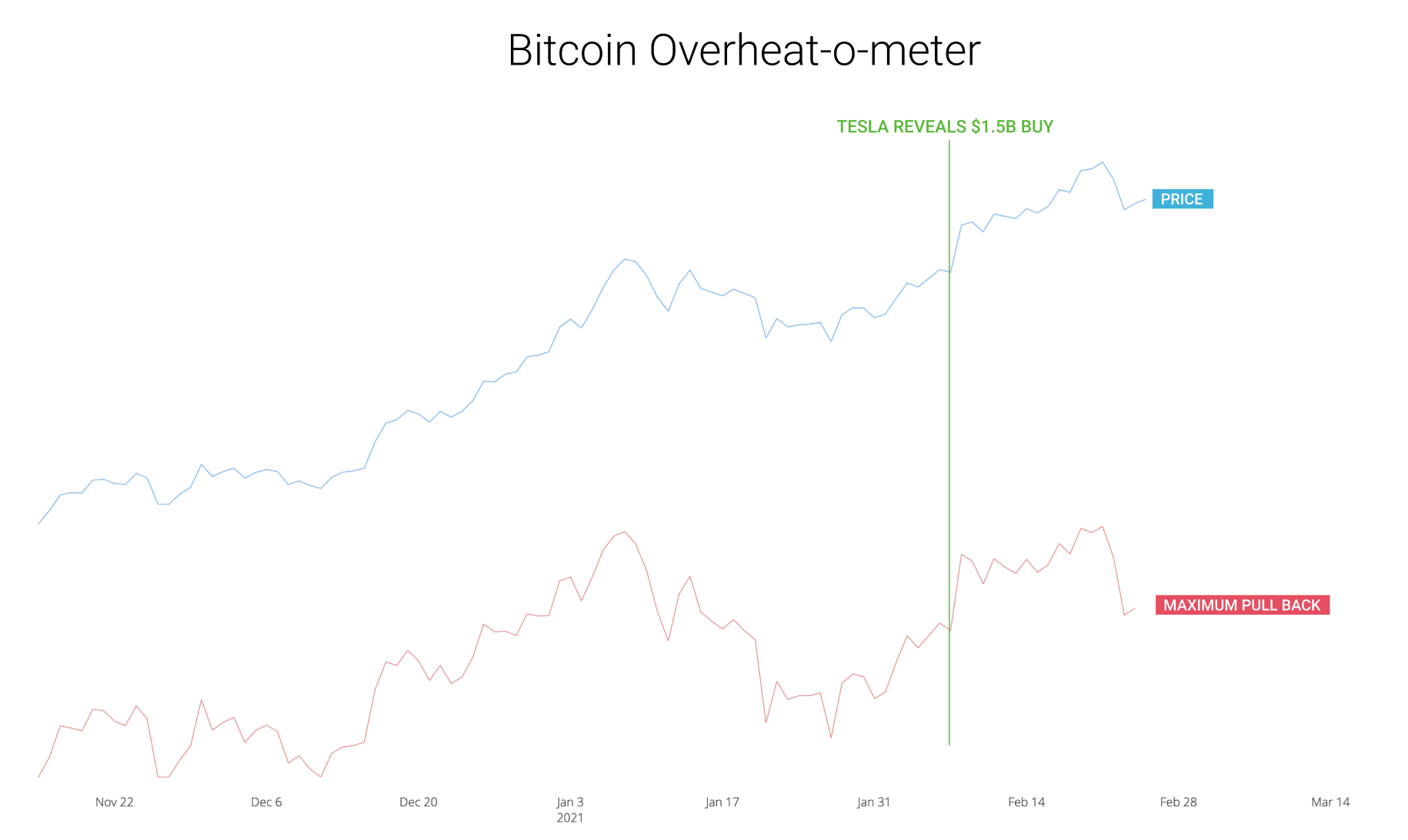

This puts us in a region of ~21% maximum price pullback. I consider this to be “middle of the road” of what’s to be expected in a bull market. Not too hot, not too cold (i.e. cheap).

Downside price moves continue to reduce in this cycle

In similar stages of previous cycles we traded at peak pullbacks of 66% and 44% (2013 and 2017 respectively). I’ve run a trendline through this reduction, I think it’s a fair guess that pullbacks in this bull cycle will be contained within ~33%. The market continues to mature with increased liquidity.

Price action expectation and targets

Speculative fervour has reset allowing price to cool down. We’re now trading in what I consider a “middle of the road” warm zone, with a backdrop of institutional and retail investors pouring capital into the network.

I’m expecting 1-2 weeks of sideways to bullish price consolidation before a bullish breakout to explore new all-time-highs.

$47k is very strong support, I don’t think this will break down, though the overheat-o-meter certainly frames this as possible. Should this level fail, $40k would be an area where I would recommend buying the dip unrestrained; this level will hold short of a black swan event.

Once again I’ve included Fibonacci Price levels in the chart below which readers may find useful as price targets, whenever we break all-time-highs, these fib levels are the only areas of resistance when we have no prior history to fall back on in the price discovery mechanism. Breaking past $58k will be a quick path to $63k, and a subsequent target of $74k thereafter.