Quick references for common trading terminologies

Full Glossary

Full comprehensive Glossary page >> https://tradetoprospa.net/glossary

Long / Short

Is defined by the trade direction

> Long = when price goes up and you profit from it

> Short = when price goes down and you profit from it.

Bid and Ask

> BID = the price you can sell it at

> ASK = the price you can buy it at

Spread

> The difference between the BID price and the ASK (asking) price

Market

> Enter the market now

Pros: You know you will be in the trade

Cons: You might pay a premium as the price goes up or down.

Limit

> Enter only if the market comes to your desired price (pullback)

Pros: Enter at cheaper price

Cons: You might miss the move or trade as your trading against current momentum

Stop

> You only enter if the market moves in your favour (breakout), you get into the trade

Pros: Enter the trade with momentum

Cons: You might enter a false breakout

Stop Loss

> It helps you get out of a trade. Risk management. Its your insurance policy if the market drops, you cut you loses.

Pros: Stops further losses

Cons: The market might reverse back and you will lose that position or direction of the market

Soft Stop Loss

A “soft stop-loss” is a term used in trading and investing to describe a type of stop-loss order that is set at a specific price level but allows for some flexibility in execution. Unlike a “hard stop-loss,” which triggers an automatic sell order when the specified price is reached or breached, a soft stop-loss gives traders more discretion and may allow for some tolerance beyond the specified price.

Here’s how a soft stop-loss typically works:

Setting a Price Level: A trader decides on a specific price level at which they want to limit their potential losses. This price level is often set based on technical analysis, risk management principles, or personal trading strategies.

Execution Flexibility: Instead of placing a strict and automatic sell order at the specified price, a soft stop-loss allows the trader some discretion. When the market price approaches or reaches the soft stop-loss level, the trader assesses the situation and decides whether to execute the sell order or wait for further price action.

Risk Assessment: Traders using soft stop-losses often consider factors like market volatility, news events, and overall market conditions when deciding whether to sell or hold. They may give the price some room to fluctuate in the short term before making a final decision.

Manual Execution: If the trader determines that the price movement is a temporary fluctuation and not a fundamental change in the market’s direction, they may choose not to execute the sell order. Alternatively, if they believe the price is likely to continue moving against their position, they can manually execute the sell order.

The advantage of a soft stop-loss is that it allows traders to avoid getting “whipped out” of a trade due to short-term price fluctuations or market noise. It gives traders the opportunity to make informed decisions based on real-time market conditions, rather than relying solely on automatic orders that can trigger prematurely.

However, the drawback of a soft stop-loss is that it requires active monitoring of the market, which may not be suitable for all trading styles or situations. Traders must exercise discipline and stick to their risk management rules when using soft stop-losses to prevent larger losses if the market moves against them.

Ultimately, whether to use a soft stop-loss or a hard stop-loss depends on a trader’s strategy, risk tolerance, and the specific market conditions they are trading in. It’s essential for traders to have a clear plan in place and to follow risk management principles to protect their capital.

Hard Stop Loss

A “hard stop-loss,” also known simply as a “stop-loss,” is a predefined price level set by a trader or investor to limit potential losses on a position. When the market price of an asset reaches or breaches this specified level, a hard stop-loss order becomes a market order and is automatically executed. The purpose of a hard stop-loss is to help manage risk and prevent significant losses in a trade or investment.

Here’s how a hard stop-loss works:

Setting a Price Level: A trader determines a specific price level at which they are willing to sell an asset to limit potential losses. This price level is often based on technical analysis, risk management principles, or the trader’s strategy.

Placing the Order: The trader places a stop-loss order with their broker or trading platform. The order includes the asset to be sold, the stop-loss price, and the quantity to be sold if the stop-loss is triggered.

Automatic Execution: When the market price of the asset reaches or falls below the specified stop-loss price, the stop-loss order becomes a market order and is executed immediately. The asset is sold at the prevailing market price, which may be lower than the stop-loss price if there is a gap or rapid price movement.

The primary advantages of using a hard stop-loss include:

Risk Management: It helps traders and investors limit potential losses and protect their capital.

Discipline: It enforces a predetermined exit strategy, reducing the emotional aspect of trading decisions.

Automation: Once set, a hard stop-loss order does not require continuous monitoring and will be executed automatically when needed.

However, there are some important considerations when using hard stop-loss orders:

Slippage: In fast-moving markets or during gaps in trading, the execution price of a hard stop-loss may differ significantly from the stop-loss price.

Whipsaws: A market may briefly dip below the stop-loss level and then reverse, triggering the stop-loss order before recovering. This can result in exiting a position prematurely.

Market Orders: Once a hard stop-loss is triggered, it becomes a market order, meaning it is executed at the prevailing market price. In highly volatile markets, this can result in a less favourable execution price.

Traders should carefully consider their risk tolerance, market conditions, and trading strategy when setting hard stop-loss levels. It’s essential to strike a balance between setting a stop-loss that’s too tight, which can lead to premature exits, and one that’s too loose, which can result in larger losses. Additionally, some traders may use trailing stop-loss orders that automatically adjust as the market price moves in their favor to capture profits while still limiting potential losses.

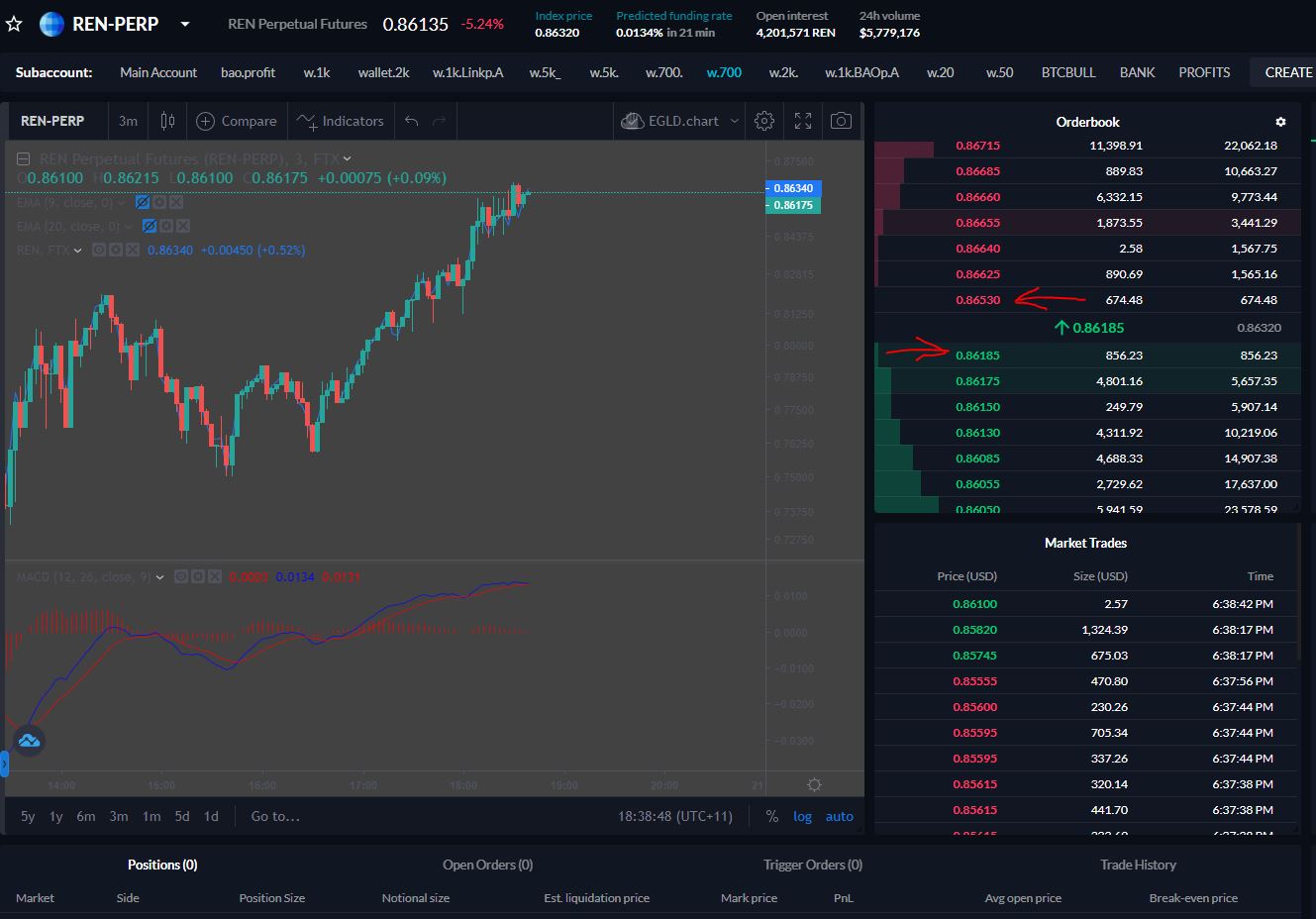

Elements with the exchange panel (1)

What is a spread – refer the chart below

> The spread term is the difference between the BID price and the ASK price

> Stocks that have large capital, have more liquidity (tighter bidask spread)

> Small cap stocks have less liquidity (larger bidask spread)

> Basically the volume of transactions for that particular stock can be scares or heavy.

Where is the BID and ASK price?

We have the red and green section. The red is the “ASK”ing price (0.86530 cents)The green is the “BID”ing price (0.86185 cents)

The difference in their prices is the spread.

Going Short

> This is when you borrow from the exchange (stock) and then sell it at a price with the intension of buy the stock back at a lower price.

> Therefore you make money by keeping the difference. Note the stock has to be payed back along with being charged with a fee + interest.>In such cases, you need equity to be able to borrow and sell on the exchange.

Going Long

> This is when you sell the stock that makes a quick move towards a known resistance where you will sell the stock.

Pump and dump

> This is a common phrase by investors and traders after an asset has inclined strongly with big gains to a point that profit taking is inevitable. Usually such price actions are unexpected by recent trends. Its usually looks like manipulation

Sell the pumb

> This is when you sell the stock that makes a quick upward trend towards a likely resistance level where will sell the stock

Buy the dips

> “Buy the dips” is a common phrase investors and traders hear after an asset has declined in price in the short-term. Therefore, they are buying when the price drops in order to profit from some potential future price rise. Usually a short-term decline, in repeated fashion.

> This is usually a measured or planed price level which is likely to be in the support range or just below it.

Elements with the exchange panel (2)

When trading, the exchange provides you with the tools to buy and sell the stock. The tool suite general provides you with the options as to how you want to buy and how you want to sell or manage risk. It is probably better to watch the video if you need a demonstration as to what these are:

MARKET ORDER

A market order is an trade order to buy or sell immediately, meaning what ever the price offer is at the time.

In some cases going long or short with this type of order can be bad as you will buy or sell much more than your expectations, especially selling when there is a dump, the order book could be very low prices.

LIMIT ORDER

Limit orders set the maximum or minimum price at the time which you are willing to complete the transaction. Its a fixed price and it could mean you have to wait until the orders (order book) reach your price. In many cases, they might

not hit your price and you miss out.

STOP MARKET

This is another strategy to stop your losses on a trade.A market stop is basically a stop loss tool where you provide a trigger price (when price hits this level, it triggers the rest of the order) and hence will either buy or sell

what ever the market price is at the time. For low liquidity stock or crypto, this can be dangerous as the next price could be very high or very low.

STOP LIMIT

A stop limit order or stop loss is also another strategy to stopping your losses in a trade, meaning you place an order to limit your losses.

By placing a stop limit, you basically place an order with a trigger price and then a price to either buy at or sell at price (if your are shorting, you buy and if you are longing, you sell). This is usually done so when your not

watching your trade, the order is like an insurance policy that you limit your losses. In many cases, you can also use it to get into a trade when not watching.

TRAILING STOP

Its a stop limit that trails price with specific (buffer) settings. It follows price in the trend and updates its stop loss level.

TAKE PROFIT

Take profit is an order that you place to (partially) close your position once it reaches a certain level of profit. One can have multiple TP points.

TAKE PROFIT LIMIT

A “take profit limit” is a specific type of order used in trading financial markets, such as stocks, forex, or cryptocurrencies. This order is designed to automatically close a trade at a predetermined profit level, helping traders lock in gains.

Here’s how it works:

Setting a Target Price: When a trader enters a position (either a buy or sell order), they may set a specific price level at which they want to take profits. This predetermined price level is known as the “take profit limit” or simply “take profit.”

Automatic Execution: If the market reaches the specified take profit limit, the order is automatically executed, closing the trade at the desired profit level. This is done to ensure that the trader captures gains before the market conditions change.

Risk Management: Take profit limits are an essential part of risk management strategies. By setting a target for profit-taking, traders can establish a favourable risk-reward ratio for their trades. This helps them avoid the temptation to hold onto a winning position for too long, risking a potential reversal in market conditions.

Hands free Trading: Take profit limits enable a more automated approach to trading. Traders can set their profit targets when placing the initial order, allowing them to step away from the computer without worrying about constantly monitoring the markets.

It’s important to note that while take profit limits can be beneficial, they also come with certain considerations. Markets can be volatile, and prices may not always reach the specified level before moving in the opposite direction. Additionally, unexpected events can impact market conditions. Traders often use a combination of take profit limits and stop-loss orders to manage their trades effectively.

ORDERBOOK

We have the red and green section. The red is the “ASK”ing price (0.86530 cents)

The green is the “BID”ing price (0.86185 cents)

The difference in their prices is the spread.

POSITIONS

A”position” refers to an investment or trading commitment in a financial instrument, such as stocks, bonds, commodities, currencies, or derivatives. A position can be established by buying (going long) or selling (going short) a financial instrument.

Here are two common types of positions:

Long Position: In a long position, an investor or trader buys a financial instrument with the expectation that its value will increase over time. For example, if you buy shares of a company, you are said to have taken a long position in those shares. Profits are made if the value of the instrument rises.

Short Position: In a short position, an investor or trader sells a financial instrument that they do not own, with the expectation that its value will decrease. To close the short position, the trader buys back the same amount of the instrument at a later time. Profits are made if the value of the instrument falls.

The terms “long” and “short” are often used to describe market participants’ outlook on the direction of asset prices. If someone is bullish, they take a long position, expecting prices to rise. If they are bearish, they take a short position, anticipating that prices will fall.

The size of a position is typically measured in terms of the quantity of the financial instrument involved. Traders and investors use various strategies and analysis techniques to determine when to enter or exit positions based on their market outlook and risk tolerance. Positions can be held for varying time frames, from short-term intraday trades to long-term investments.

OPEN ORDERS

An “open order” typically refers to an order placed with a seller that has not been fully executed or completed. In various contexts, the term can have slightly different meanings:

E-commerce and Retail: In online shopping, an open order could refer to a purchase that has been made but not yet shipped or delivered.

In the context of financial trading, an open order is an order to buy or sell a security that has not been filled. It remains active until it is either executed, canceled by the trader, or expires.

In all cases, the term “open order” signifies that the transaction is still in progress, and the desired action (shipment, execution, or fulfillment) has not yet taken place. Once the order is completed, it is typically referred to as a “closed” or “filled” order.